Flatex, Wikifolio & Co: How to Invest Money in 2019

Since one of my personal goals for 2019 is to save money I thought about my financial account at my bank. The good thing is that I am able to save some money, but the reality is that all the saved money loses value day by day. This is no news, because this development has started since the financial crisis in 2008. Surprisingly, Austrians have not changed their finanicial behaviour much since then. About five percent of Austrians invest in shares. My thought was, to risk or invest at least a quarter of my savings in shares. At the beginning it seems as a big step, but if you are in the process of investing itself, it feels not that risky anymore as most Austrians would believe.

First Steps with Flatex

The first thing is to find a direct (online) bank that supports investing in shares, electronic traded funds (ETFs) or other financial products. After some research I decided for Flatex. I would say that there are many financial providers out there, that are good alternatives. For me, it was important that it had an Austrian domain and an interesting discount model when it comes to the first investments on the finance platform. Flatex provides with a reduced fee within the first six months. My financial strategy is long-term, so I am not willing to buy and sell multiple times within days, weeks or months. My financial portfolio should be set up within the first six months and held long-term.

Wikifolio

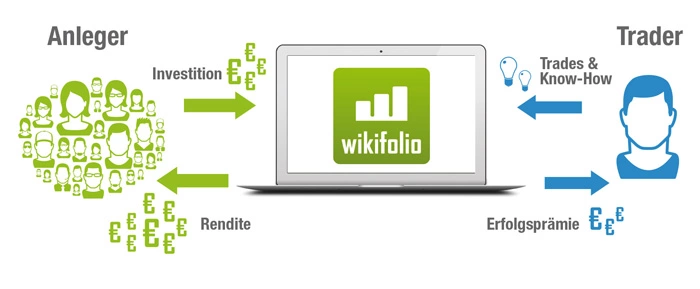

Wikifolio is an Austrian founded company which basic vision is to bring more transparency in financial investements and enable people to do it on their own without intermediaries. The platform is actually a collection of trading ideas. There are several steps to evolve yourself on this platform. My first step was to browse through finanical portfolios that matched my basic interests in software and technology. By doing this I found out which shares and portfolios had a very positive development over the last years. Another step is to make your own portfolio public on the platform. If you are attacting at least ten potential investors the portfolio can be traded as any other finanical product. For me it is ok to browse through trading ideas and enrich my personal portfolio.

My Personal Portfolio

My first feeling was that I should invest in the companies and products I know best due to my daily work life. As I was mostly busy in my life at developing or implementing software systesm, the question was quite simple. Why not invest in exactly these companies. I like this products and I have big trust that these companies will survive the next years and increase in value. You can watch my current idea of the final portfolio in 2019 at Wikifolio. I am not there yet, but I will keep shifting my saved money to the companies and products I believe in as for example Apple, Netflix, Microsoft, Adobe or Oracle. In the next years I like to hold about 25 to 50 percent of my saved money in shares.

Feedback

Back to top